Financing a truck can be challenging when a customer wants to make a purchase, but their credit score is… not so good. We’re here to help and we’ll do what we can to facilitate the deal. However, we still need to justify the financing agreement to our own bank. If they won’t approve the loan, we will not be able to offer it.

To help make a deal happen, it’s important to know where your credit stands.

What is a Good Credit Score?

A credit score is calculated using information from your credit report. Factors that make up your credit score include your payment history, the amount of debt you have, and the length of your credit history. Your credit score will be used by potential lenders and creditors to determine whether you can secure a loan by how likely you are to pay back the money that is lent to you.

It is important to remember that everyone’s financial and credit situation is different. There is no “magic score” that guarantees better loan rates or terms. However, having a good score can increase your chances of qualifying for a truck loan with a lower interest rate and more favorable terms. Keep in mind, lending criteria and rates can vary depending on the lender.

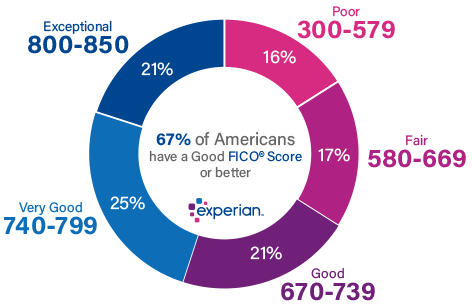

So, what is a good credit score?

Poor: 300 to 579

Fair: 580 to 669

Good: 670 to 739

Very Good: 740 to 799

Exceptional: 800 to 850

Source: Experian

People in the Excellent, Very Good, and Good ranges are considered acceptable, low-risk borrowers. Having a credit score between these ranges makes securing a loan easier. These borrowers have a positive credit history which includes on-time, consistent payments; long-term credit record; diverse credit (credit cards, auto loans, mortgages); and limited credit inquiries.

People in the Poor or Fair ranges often have difficulty being approved for a loan. While your credit score might be lower than average, there are alternatives that can help you get approved. First things first, it is important for those with little to no credit to begin working on improving your score and building credit history.

Credit Dealbreaker

Having little, poor, or no credit doesn’t have to be a dealbreaker when financing a truck with Coopersburg & Liberty Kenworth. We understand that everyone has to begin somewhere. The first place to start: fixing or building your credit. Read our Tips for Financing a Truck with Bad or No Credit. With our support, you can take the first step toward owning the Kenworth truck you’ve been dreaming of while beginning to build a positive credit history!

Financing a Truck with Bad or No Credit

If you fall into the range of Poor or Fair credit, don’t be deterred! There is still a way to secure financing for your vehicle. Whether you’re a first-time buyer or have challenged credit, we are here to help you. There are options specifically designed for individuals who fall within that credit range.

Discover your financing options by contacting our Finance Manager or fill out our Financing Form. He’ll be happy to answer any questions you may have and guide you through the process of financing your next truck!

Sign Up for Exclusive Blog Content

"*" indicates required fields